Ideally, you should at the very least wait about 6 months prior to deciding to apply for an auto loan. That offers you time to maintenance your credit history and rebuild credit history, as well. You make payments on any loans you've left to create a constructive credit history heritage.

As usually, the proper bank loan variety for you will count on your money circumstance and the home you’re buying. But for many borrowers with past credit score challenges, an FHA bank loan could be the right Alternative.

For Chapter 13, to maintain the car, it ought to possibly be safeguarded by exemptions, or else you need to have the opportunity to shell out creditors to the equity that is not exempt.

Bankruptcy is one particular debt aid possibility amongst many. Prior to deciding to choose ways to progress, it’s crucial to comprehend the fast consequences of seeking bankruptcy protection. After your filing is recognized, the court docket prohibits creditors from using collection actions against you. This “computerized continue to be” ensures that you’ll be lawfully safeguarded towards harassing phone calls, wage garnishment, service cutoffs as well as other creditor steps until eventually the situation is settled.

Attain Economic focuses primarily on loans for the goal of preventing bankruptcy. The business has a terrific status, each While using the BBB and its purchasers.

Though the results of bankruptcy hang around for 7 to ten years in your credit report, that’s not how long you must hold out to borrow funds. The impact in the penalty decreases each and every year, and it’s even probable to obtain a automobile mortgage inside six months of your respective discharge.

We do not give economical suggestions, advisory or read this post here brokerage expert services, nor can we advocate or suggest men and women or to purchase or sell certain hop over to here shares or securities. Efficiency data may have adjusted since the time of click this site publication. Earlier functionality is not indicative of long run results.

That is determined by the company, but Of course: most personal debt consolidation courses provide you with a bank loan to pay back your entire outstanding debts. These loans usually have A great deal lower desire prices and will let you get along with your fiscal scenario yet again.

FHA financial loans: Any function that lessened your household money by 20% or more for at least six months is taken into account an eligible circumstance via the FHA

Co-signers are not chargeable for monthly payments unless you tumble at the rear of on payments or default with your bank loan. This also indicates any damaging payment activity can impact their her explanation credit history rating.

Stay clear of everything that’s “contingent,” “adjustable,” or “conditional.” Loans that have fastened payments around their entire existence are particularly easy to handle.

They’ve identified you for just a long time and they’ll function along with you. 2nd, you can try out poor credit history car lenders. They’ll charge you extra, but They can be a legit method of getting a new list of wheels.

A relatives organization Started in 2008, WeFixMoney has preserved the highest benchmarks in customer service and safety for a hop over to these guys decade. Our mission is to help you remedy your short-term funding requirements and we won't ever use your information and facts for every other goal.

In case you're contemplating filing for bankruptcy, you're not alone. Every year, numerous 1000's of people file for bankruptcy as a consequence of their too much to handle credit card debt.

Michelle Pfeiffer Then & Now!

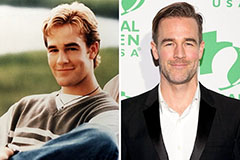

Michelle Pfeiffer Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!